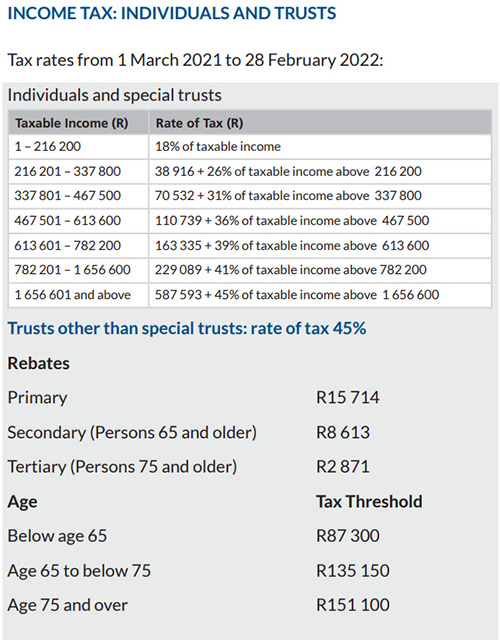

Tax Brackets 2025 Sars - Tax Brackets 2025 Sars. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Rates of tax for individuals. Budget 2021 Your Tax Tables and Tax Calculator SJ&A Chartered, Single taxpayers 2025 official tax. 2025 / 2025 tax year:

Tax Brackets 2025 Sars. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Rates of tax for individuals.

New Tax Brackets 2025 See How You're Affected for Social Security, If sars views the profits from crypto dealings as income, they will be taxed at marginal rates applicable to individuals (up to 45%) or companies (27%). 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Tax rates for the 2025 year of assessment Just One Lap, There areseven federal tax brackets for tax year 2025, and the irs has increased its income limits by about 5.4% in 2025 for each bracket. Sars tax tables for businesses.

Irs New Tax Brackets 2025 Romy Carmina, Bianke neethling • 16 may 2025. R95 750 and thee am younger.

Tax rates for the 2025 year of assessment Just One Lap, 2025, 2025, 2022, 2021, 2020, 2019, 2018, 2017, 2016, 2015, etc. Taxable income and filing status determine which.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, Finance minister enoch godongwana has. If sars views the profits from crypto dealings as income, they will be taxed at marginal rates applicable to individuals (up to 45%) or companies (27%).

Tax Brackets 2025 South Africa Goldy Karissa, Sars tax tables (tax brackets) for individuals. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

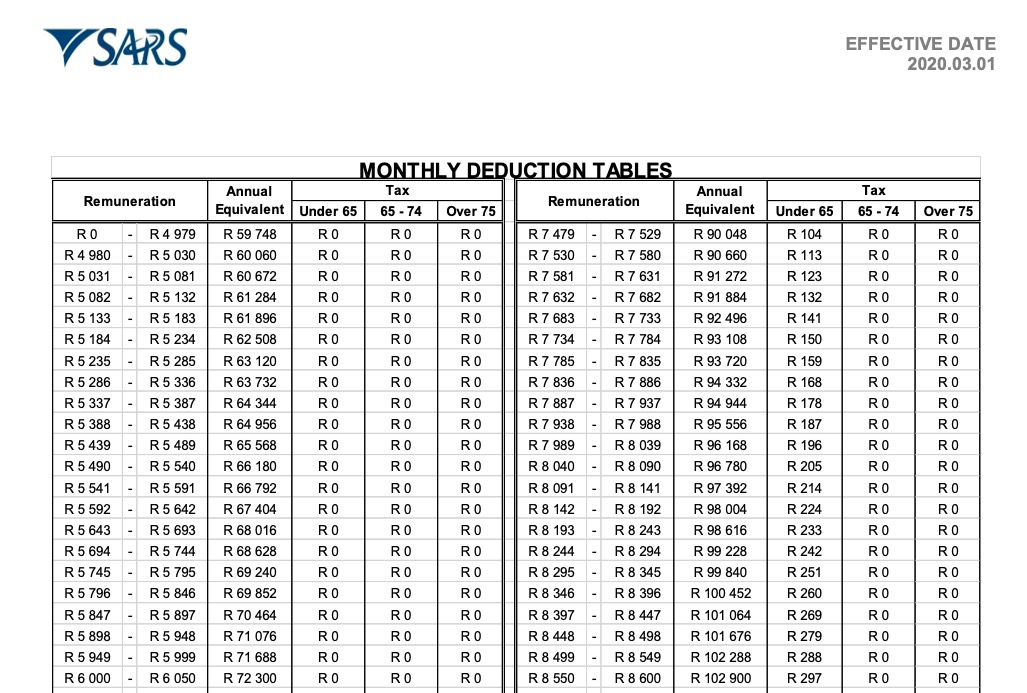

Use our employee’s tax calculator to work out how much paye and uif tax you will pay sars this year, along with your taxable income and tax rates.

2025 Federal Tax Tables Single Edith Leanor, In south africa, you are liable to pay income tax if you earn more than: 42,678 + 26% of taxable income above 237,100.

2025 Tax Brackets And Rates carlyn madeleine, If sars views the profits from crypto dealings as income, they will be taxed at marginal rates applicable to individuals (up to 45%) or companies (27%). It is important to note that sars financial year starts in february and ends in february of the following year.

However, the deadline for residents of maine and massachusetts is april 17, 2025.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, Taxable income (r) rates of tax. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

It is important to note that sars financial year starts in february and ends in february of the following year.

Rates of tax for individuals. Use our employee’s tax calculator to work out how much paye and uif tax you will pay sars this year, along with your taxable income and tax rates.